Detroit Free Press: Michigan's risky Palisades reactor restart is behind schedule

Roger Rapoport

Op-ed contributor

March 2, 2026

Just six months after receiving its first operating license for a nuclear reactor, Holtec International’s “unprecedented milestone in U.S. nuclear energy” may be turning into a millstone.

Holtec is attempting the first-ever reopening of a nuclear plant permanently closed for decommissioning – the Palisades reactor, near Lake Michigan in Van Buren County, which was shut down in 2022.

Restarting this reactor has always been a risky bet. Twenty-one months into the project, Holtec has announced delay after delay while continuing to draw vast public subsidies to restart a plant that a far more experienced operator shut down. As management fails to submit required documentation, costly nuclear fuel sits idle at Palisades, and Holtec seeks exceptions from Nuclear Regulatory Commission for work on a reactor so noncompliant that no government agency would even consider approving its construction today.

As the project stutters, it's becoming clear that Washington and Lansing lawmakers are gambling Michigan’s reputation on the dangerous restart of the wrong reactor.

Delays and exceptions

After multiple delays, stretching back to June 2024, Holtec, a New Jersey company with zero nuclear reactor operating experience, is back in line at the Nuclear Regulatory Commission seeking forgiveness for unpermitted welding on the 55-year-old Palisades reactor pressure vessel containment head.

This ask, likely to take many months to review, comes after a late 2025 NRC amendment to the Palisades fire safety plan to comply with current government reactor standards. It also follows a controversial NRC exemption related to resleeving approximately 1,400 cracked tubes at the plant’s ancient steam generators, as well as a unique October 2025 accident in which a worker fell into the reactor vessel and had to be fished out.

A day after Gov. Gretchen Whitmer boasted in her state of the state address that Michigan has become the “first state to ever restart a nuclear power plant at Palisades” the Nuclear Regulatory Commission released a transcript of a Feb. 12 letter to Holtec announcing yet another “change in the reactor’s estimated review schedule.”

Citing “the need to request additional information from Holtec,” the agency said it “expects to complete its review by April 8.”

The agency cautioned that “these estimates could change due to several factors such as subsequent requests for additional information and an unanticipated addition of scope to the review.”

To the surprise of the financial community and the nuclear industry at large, Holtec is betting the farm on an NRC “relief request” unprecedented in the 68-year history of American atomic power.

In an 84-page filing released by the NRC in late January, Holtec concedes this unauthorized welding does not comply with American Society of Mechanical Engineers (ASME) standards.

This is a humiliating blow to the bipartisan coalition in Congress and the Michigan Legislature backing this unprecedented reactor restart, with billions in grants, subsidies and loans.

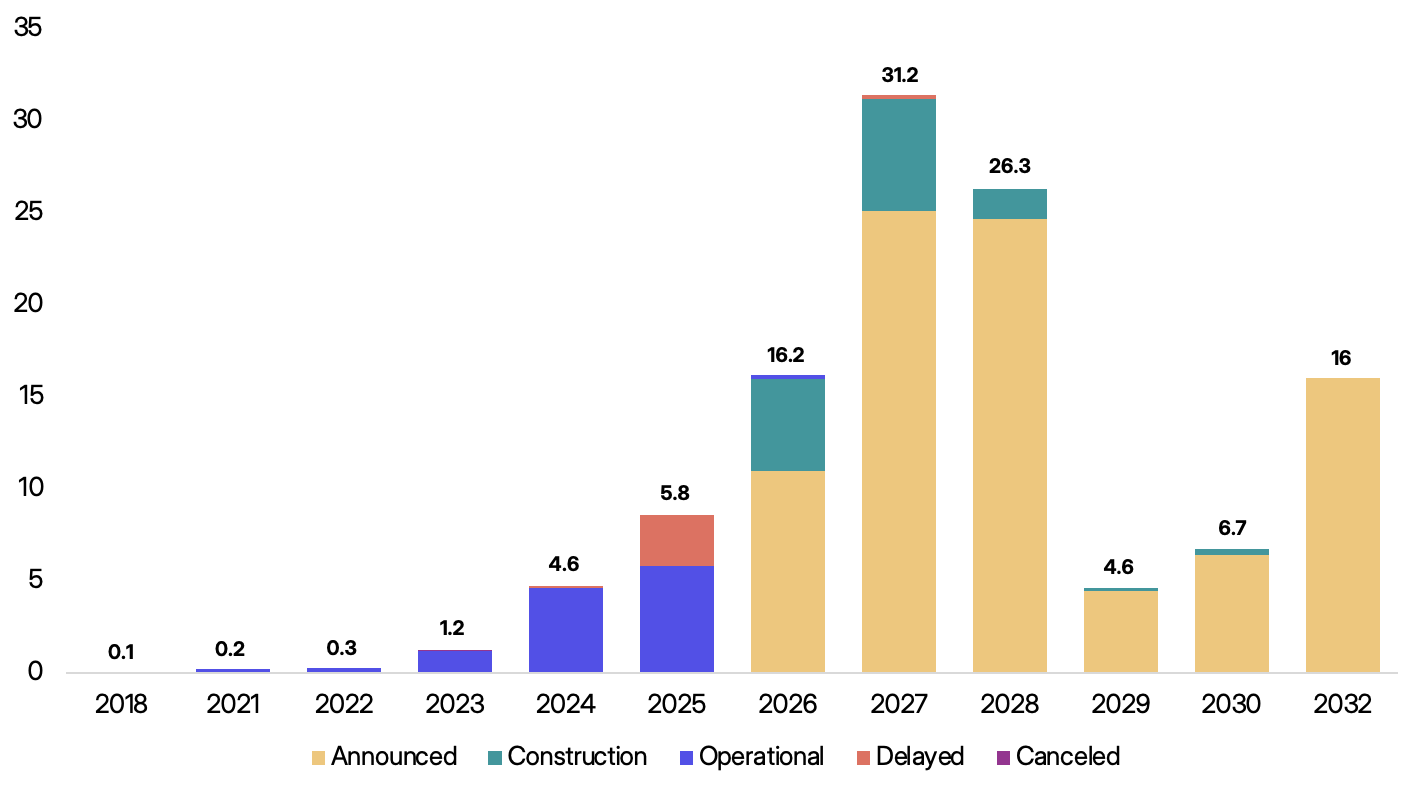

These new safety challenges at Palisades could threaten financing of the entire atomic energy industry. Continued Holtec startup delays could also crush the Trump and Whitmer administrations’ plans to subsidize two more Holtec nuclear plants at the Palisades site with a startup $400 million grant. Michigan previously approved two $150 million grants for the project, and the U.S. Department of Energy authorized a separate $1.5 billion loan. Anticipating a green light, Holtec has already clearcut vast acreage to make room for these first-of-their-kind reactors.

Kevin Kamps at the advocacy group Beyond Nuclear estimates the tab for state and corporate welfare at this Covert Township reactor, as well as the Big Rock Point reactor site near Charlevoix, could top $16 billion. This underscores why Holtec is in a hurry to launch an initial public offering aimed at netting up to $10 billion.

Windfall profits for an inexperienced nuclear operator

A windfall of this kind would be a remarkable achievement for the rookie New Jersey-based reactor operator. It bought Palisades in 2022 for decommissioning after it was shut down ahead of schedule by nuclear fleet operator Entergy Nuclear. After drawing down many millions from the Palisades decommissioning trust fund the Holtec team did a series of repairs on the 55-year-old reactor. Last summer the NRC granted Holtec an operating license. The restart schedule has been delayed for agency review of Holtec’s welds involving the Reactor Pressure Vessel Closure Head, Control Rod Drive Mechanism and InCore Instrumentation Penetrations.

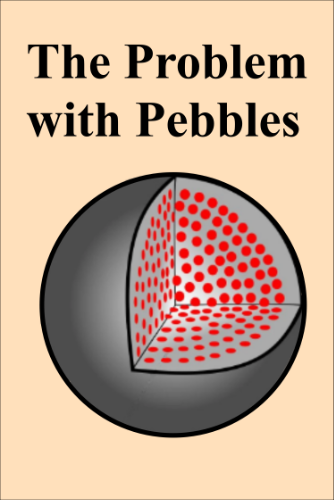

Central to this work are nozzles sealing off control rods held in long tubes atop the 150-ton reactor pressure vessel head. The control rods are inserted to turn the reactor off and removed to start it up. Part of the primary coolant system, these nozzles contain a radioactive boric acid solution.

After a 2002 boric acid spill ate a frightening hole in the reactor pressure vessel head at Ohio’s Davis-Bessie reactor, nuclear reactor owners nationwide repaired or replaced their vessel pressure heads at the urging of the NRC.

Consumers and its successor, Entergy Nuclear, skipped these overdue upgrades. They saved time and money by submitting to two decades of stepped up NRC reactor inspections. That special treatment led to additional shutdowns that cost millions per day. This expense and other safety related challenges persuaded Entergy to give up and sell the obsolete plant to Holtec for government-subsidized decommissioning.

Today, a Palisades restart requires NRC approval of unauthorized and noncompliant welds at the plant.

Too dangerous to get wrong

Critical to the NRC’s review is analyzing the possibility that Holtec’s unauthorized welds could contribute to a dangerous leak. If that happened, highly radioactive boric acid could be dumped on the reactor head, similar to the Davis-Bessie disaster.

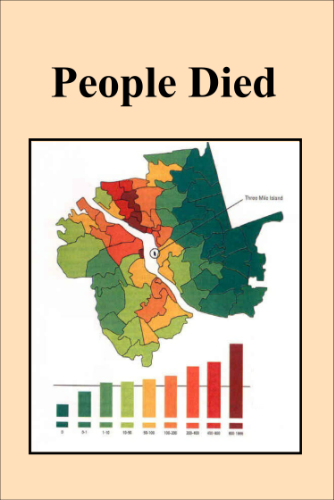

This would lead to an immediate safety-related shutdown causing reputational damage to the nuclear power industry. It could also erode investor confidence in the viability of other startups seeking federal and state funding. Among those are the Google/Meta backed restarts of reactors at Pennsylvania’s Three Mile Island and Iowa’s Duane Arnold Energy Center.

Alan Blind, Palisades director of engineering for six years and former vice president for nuclear at New York’s Consolidated Edison says: “Holtec’s new relief request makes it clear they did not follow the NRC-required ASME standards on this unapproved welding work. No nuclear reactor company in the world that would have gone ahead on this work without advance regulatory approval. I don’t know of any company that has done nozzle welding this way.”

The questionable work focuses on nozzle welds at the bottom of the control rod tubes. As required by NRC regulations, reactor operators submit their welding code relief requests for review and approval prior to starting this critical work. Because it previously ran the plant on a decommissioning license, Holtec proceeded on the legal theory of “implied consent.”

Blind says Holtec’s new exemption request under an operation license “makes it clear the plant is completely out of compliance. There is no easy way to fix what they have apparently done wrong on the latest welds. If the NRC turns down Holtec’s unique proposal, restart of the plant could require replacement of the reactor pressure vessel containment head at a cost of up to $750 million. This could slow the restart by years.

"This solution, plus the plant’s long overdue need to upgrade its obsolete steam generators, could cost $1.5 billion or more and take up to five years. That doesn’t take into account other potential safety problems.”

Missing paperwork

Another potential challenge is that plant operators are required to submit quality assurance paperwork documenting that welds to the reactor head control rod pressure spray nozzles follow ASME code.

At a Feb. 9 NRC meeting on a related matter, Holtec conceded it does not have required quality assurance paperwork proving metal in the original construction is compatible with new Holtec welds proposed for the Palisades reactor pressurizer. Failure to provide this kind of critically important quality documentation central to safe operation could cripple a restart plan.

Don’t Waste Michigan Director Michael Keegan says: "In this meeting, Holtec admitted it has not been able to retrieve these quality assurance documents proving it can meet required ASME code and has no idea when they will be available. In effect Holtec is telling the NRC ‘the dog ate my homework.’”